Become Your Client's Holistic Advisor

Enhance your client-advisor relationship by offering holistic planning that addresses all your clients' needs, shifting away from outdated traditional financial planning methods.

Why Holistic Advising

Advisors who take a holistic approach can really get to know their clients and help them reach their long-term goals. This method looks at every part of a client's finances, like income, expenses, investments, insurance, taxes, and estate planning. By focusing on the big picture instead of just specific products, advisors can offer more value and build stronger relationships. In today's complex financial world, holistic financial planning is a key ingredient for financial security and success.

Become A Holistic Advisor in 3 Easy Steps

Leverage the Power of Referrals

Advisor referrals and introductions can improve holistic advising by creating a stronger support network for clients. You can use your connections to offer various specialties or join the IronClad Family Advisor referral network to connect with advisors in different disciplines & specialties and in different states per regulations.

Asking the Right Questions

Ask targeted questions about financial plans, such as: "What are your long-term financial goals?". For insurance, they might ask, "Do you have adequate coverage for potential risks?". In estate planning, a question could be, "Have you updated your will to reflect your current wishes?". These questions help identify important gaps in a client's plan.

Use Holistic Advising Technology

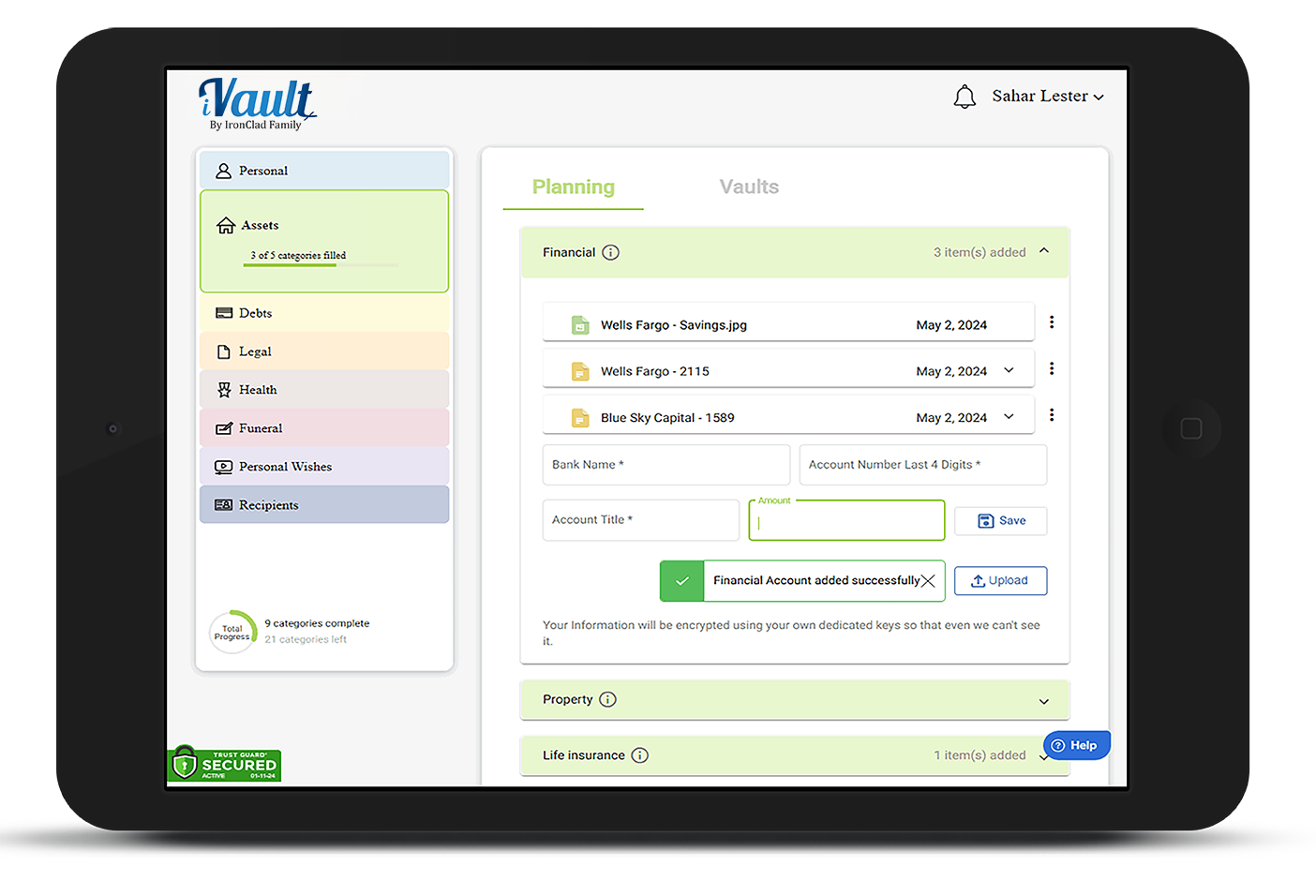

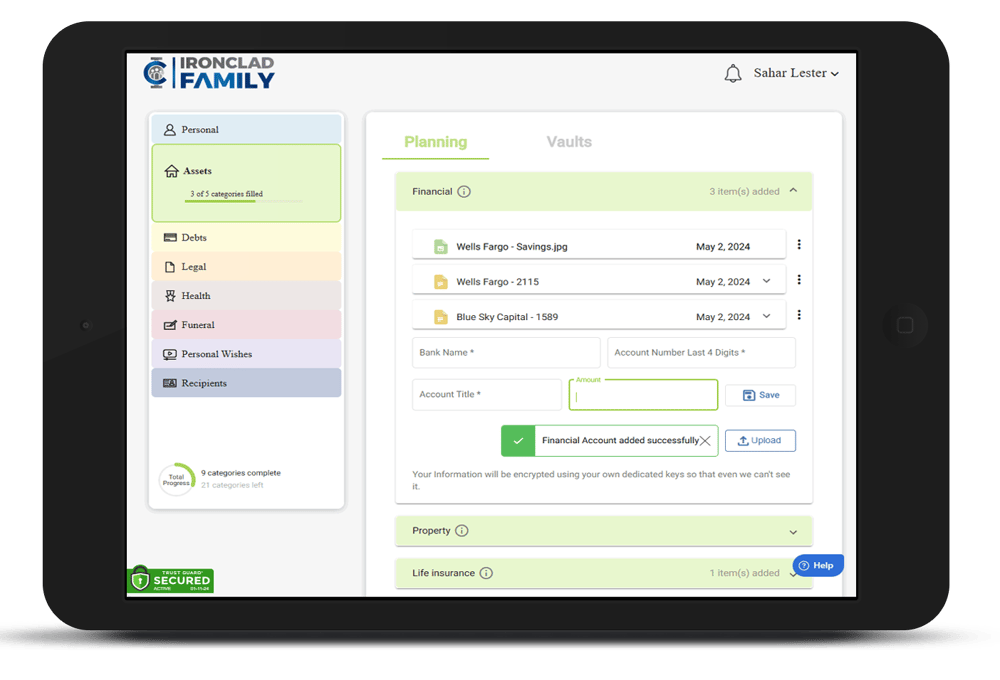

Using holistic advising technology can greatly improve advisors' ability to serve clients by covering all aspects of their lives. For instance, the iVaultx Advisor platform from IronClad Family helps advisors present a comprehensive plan to address all clients' needs and ensures their information is protected and accessible to family members.

$190,000,000 Loss

Gerald Cotton, CEO of Quadriga Fintech passed away unexpectedly when he was only 30 years old, and he took the crypto currency access codes for the $190 Million Dollars of investor’s money with him. Investor’s trusted Quadriga to invest their money in Crypto Currency, but they didn’t investigate how those investments were being protected. Gerald Cotton didn’t trust others, so he kept all of the crypto wallet access codes to himself. When he died, access to all of the crypto investments became locked and inaccessible forever. Investors in Quadriga didn’t just lose some of their investment. They lost all of it. Instantly!

$450,000,000 Loss

Stefan Thomas agreed to be paid for a job in Bitcoin. Bitcoin was worth about $1 each then and he was paid 7002 bitcoins. He put them in a wallet called “IronKey” and wrote the password on a piece of paper. Unfortunately, he later lost the paper! Over the years, he forgot the password, and IronKey allows you to mistype the password 10 times before it locks the wallet forever. At this time, those 7002 bitcoins are worth just shy of $450 Million Dollars, but since he can’t remember the password, it is all lost. It’s just gone!

We're Helping Advisors Make the Transition to Holistic Advising

Download our Holistic Adviser Guide to elevate your advisory approach and position yourself as the go-to expert in financial planning. Plus, access our Essential Documents Checklist, which is customizable with your business logo. This checklist not only helps your clients organize their vital records but also reinforces your role as a proactive, client-focused advisor. Stand out in every meeting, add real value to your services, and build stronger client trust—all for free!

BONUS - Your Brand in Your Clients' Wallets

You Can Easily Become a Holistic Advisor Today

Do This:

- JOIN our nationwide Advisor referral network.

- GET your own client dashboard to offer each client extra protection for ALL their assets and get notified if there are any changes.

- PREPARE by setting each client up with your personalized products prior to your meeting with them.

- ASK them holistic advising questions during the first meeting using our platform to pique interest in other areas of their lives and recommend a comprehensive plan.

- GIFT each client the iVaultx digital vault asset protection platform; free for them, as long as they are doing business with you.

- SHOWOFF your business brand in front of your clients even after they leave.

- BUILD relationship with their next generation over the years due to our built-in asset transference if something happened to your client.

- CLOSE more deals.

YOUR CUSTOMERS ARE ALREADY LOOKING FOR ANSWERS

“My father passed away in 2005, and he thought he had everything laid out where we would find it.

¹ Securian Financial award for "Innovation shaping the future of financial services & life insurance through technology."

The iVaultx Platform is Designed for Holistic Advisors!

Our Technology is a Must Have in The Holistic Advisor's Toolbox

Elevate Your Offering

A perfect companion to:

- eMoney

- Envestnet

- RightCapital

- AssetMap

- MorningStar

- G2Deals

- And Others!

Crypto Assets

Protect access to:

- Crypto Wallet URL's

- Access information

- Recovery keys

- Private keys

- NFT's

- Custodians

Financial Accounts

Financial Accounts

Itemize other finances:

- Assets & Liabilities

- Bank accounts and credit cards

- Login information to online accounts

- Special instructions

Codicil/ Online Will

Codicil/ Online Will

Legal Wizards Included:

- Codicil wizard for digital assets

- Online Will wizard

- Upload Living Will, Trust & Power of Attorney

Protect Everything

Protect Everything

Protect other assets:

- Legal, insurance, health, social media and funeral wishes all protected.

- Centralized access to the client's assets information from anywhere

- Unlimited encrypted vaults

End of Life Planning

End of Life Planner Included:

Our guide provides a straightforward and thorough way to document every one of their final wishes, ensuring they're accessible to chosen individuals, even in your absence.

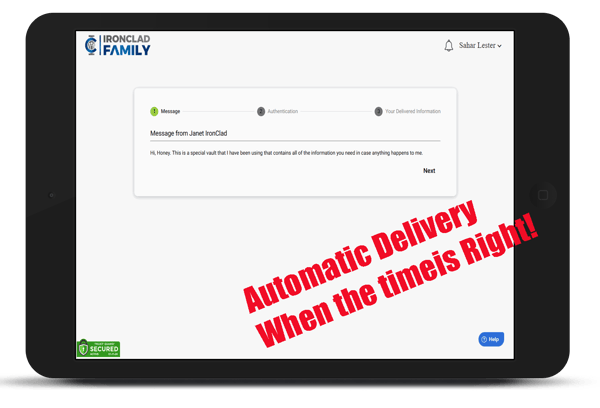

Generational Asset Transfer

Generational Asset Transfer

Delivery of asset information to loved ones:

- Assign different recipients for different vaults that can include different asset information

- Designate who and when that information gets delivered

- Options to deliver vaults based on date, manually or in case of an emergency such as death or incapacitation

Enhanced Security

Enhanced Security

We use zero knowledge encryption algorithms:

- Even we cannot see what's stored in the vaults, neither can any 3rd party

- Each client has their own encryption preventing mass hacking if one client is compromised

Holistic Advising Made Simple

We have streamlined the process and created the resources to become a Holistic Advisor! Transitioning to a comprehensive, all-in-one advising service is easy when you collaborate with IronClad Family!

-

Get added to our advisor network with diverse Specialties in insurance, finance, health and retirement planning to assist with product recommendations and leverage the power of referrals.

-

We have developed an advisor tool that facilitates an effective holistic conversation with your clients and will protect everything they care about now and future.

In addition to protecting their assets, your clients will get valuable emergency wallet cards. These are essential emergency contacts and durable business cards featuring your details, ensuring your clients will cherish and keep them.

Limited-Time Offer

Receive 100 personalized trifold brochures that highlight the complimentary benefits for your clients included with your service.

Offer Clients Holistic Protection of ALL Assets!

![]()

As a trusted advisor, I offer the IronClad Family service to my clients to protect their investments and build a relationship between myself and their family."

Mikkel Thorup

Financial Advisor | Expat Money

What separates you from other financial advisors?

Our Platform - Your

Strengthen Client Relationships

You’ve already helped your clients create and build their legacies. Extend their journey with you by helping them secure, centralize and manage important assets.

Communicate More Effectively

You’ll be notified whenever clients make changes to their digital vaults or family protection plans, enabling proactive communication about what’s most important to them.

Set Your Business Apart

Your competitors offer the same services you do. Digital family protection adds a differentiated value that only YOU can provide, helping you close new business faster.

WE ARE SERIOUS ABOUT THEIR SECURITY!

Frequently Asked Questions

What is IronClad Family’s approach to supporting advisors?

ronClad Family empowers financial advisors by championing a holistic advising model that goes beyond numbers, helping you better serve your clients by aligning financial strategies with their values, goals, and long-term vision.

How does holistic advising enhance my client relationships?

Holistic advising helps you build deeper, more meaningful connections by addressing your clients’ full financial picture, including their family dynamics, aspirations, and life events. This approach fosters trust and long-term loyalty.

Why is IronClad Family an ideal partner for financial advisors?

We are highly regarded by Securian Financial for our comprehensive support of holistic advising. By partnering with IronClad Family, you gain access to tools, resources, and expertise that enable you to deliver more impactful, client-centered solutions.

How can holistic advising differentiate me from other advisors?

By adopting a holistic approach, you stand out by offering a more personalized and impactful client experience. Clients increasingly value advisors who understand their broader goals, family needs, and long-term aspirations.

Does holistic advising work for all types of clients?

Yes! Holistic advising is effective for clients across all income levels and life stages. Whether your clients are focused on building wealth, protecting their legacy, or planning for retirement, this approach ensures their financial strategies are aligned with their unique needs.

How do I get started with IronClad Family?

We make it easy to start. Schedule a consultation to discuss how IronClad Family can enhance your advising practice and help you deliver holistic, results-driven solutions to your clients.

.jpeg)